Mining boom set to continue, analyst says

In a move that goes against the tide of late, industry analyst, BIS Shrapnel, says that the mining industry will grow as a contributor to the Australian economy over the next five years. The firm says a switch from booming construction to booming production will continue to boost economic growth.

Mining boom set to continue, analyst says

BIS Shrapnel’s new report, Mining in Australia 2013 to 2028 says  mining investment, production, contractor services and employment will follow very different paths over the next five years.

mining investment, production, contractor services and employment will follow very different paths over the next five years.

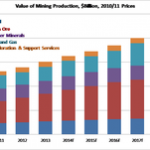

“While the mining investment boom peaked in 2012/13 and is forecast to decline 20% over the next five years, mining production is poised to grow 41% over the same period, driving commensurate increases in mining operations activities, maintenance and exports,” the analyst says.

Adrian Hart, senior manager of BIS Shrapnel’s Infrastructure and Mining Unit, thinks the majority of other analysts have gotten the wrong end of the stick in terms of the industry’s direction.

“With respect to the mining boom, it’s probably fair to say that this is not the beginning of the end, but the end of the beginning,” Hart says.

“Over the next five years, the strong boost from mining production, led by LNG and iron ore, will more than offset the economic negatives from falling mining investment which will flow through to construction and manufacturing.”

As a result, BIS Shrapnel is forecasting mining activity as a share of GDP to rise from 18.7% to 19.8%.

“Australia becomes a more mining-focused economy from here,” Hart says.

However, growth in mining employment will not keep pace with the expansion in production as miners seek to restore productivity lost during the furious race to invest in new capacity since the mid-2000s, according to the analyst.

“Miners will continue to be squeezed by lower commodity prices and a high Australian dollar over the next few years,” Hart says. “As such, they are going to extraordinary lengths to cut back on the high costs / low productivity culture which characterised the construction phase of the boom.

“We expect that mining operations employment will rise only 11% over the next five years, mainly in oil and gas and iron ore, whereas mining construction employment will slump 40%.

“Given the strong increases in production expected, this translates to a 60% labour productivity surge over the next five years.”

Source from here